Close

Any Uploan program contains the lowest wages improvement breaks. His or her on the internet finance calculator helps associates if you need to speedily calculate the expense of financial and choose a new payment term. The products too landscapes clear economic conditions and it is safe if you wish to don.

Founded with 2017, the company set from organisations to deliver income breaks thus to their providers. His or her electronic digital platform will be connected to the employer’utes platform, allowing them to instantaneously reduced payroll regarding progress payments.

By using a improve round uploan is a lightweight and start problems-free procedure. Everything you should perform is lead to a Personal Reason bdo loan table 2023 from the company’s serp and commence implement. In the event you report this, the corporation most likely try it and make a assortment at 20 or so minutes. When exposed, the company most definitely down payment funds directly into your money. And then, you may use how much money to acquire a place. The organization also offers numerous additional wins, for example totally free financial support and begin insurance.

Founded with 2017, Uploan is a Belgium-with respect loans company the pair from services in order to her operators watch breaks from other paychecks. The business employs Hour details to supply better underwriting and initiate prices regarding staff, whoever financial papers tend to be short. This supplies providers to borrow money that has been fine-tuned with their income, to stop overstretching the woman’s costs.

The organization includes a degrees of help, and a calculator which supports staff reach a good progress flow. Nevertheless it gives a free of charge credit along with a guitar fiscal verify, which is the period previously asking for capital. Members could also both put on obligations spherical all the way up and commence came to the conclusion from their payroll, a new simplicity to aid this command their funds supply.

Over generally known as Uploan, the corporation relabeled if you need to SAVii in late 2021. Any rebranding is designed to reflect the business’ersus awesome solutions, for instance plant based income linked well being possibilities your throw open monetary fuel of work. These are with-stress playing, mental help and begin related no cost insurance plan.

Ultimately, nonperforming credit might cloud banks’ chance to stream brand-new monetary. Such a thing happens from your epithelial duct of cash structure, funds and begin deficits human resources, and commence money service fees. Any canal of cash structure echos the chance-measured resources associated with the banks, and its suffering from alterations in any economy and start force pertaining to fiscal (Accornero et birmingham,al., 2017). Additionally, it could be depending on banking institutions’ myopic concern about reputation and initiate opponents.

Beyond the affect any financing ability associated with banks, if you’re a involving GNPL may shed depositors’ believe in from financial institutions. This leads to any drop by progress development and commence a great development in down payment expenses. In the end, this can lead to a terrible spherical of establishing GNPL and commence falling productivity with regard to the banks.

Any nonperforming improve is often a improve which has been delinquent with regard to a hundred years. Additionally it is termed as a unsuccessful financial or perhaps pressured fiscal. Nonperforming loans can be promoted to other banks as well as buyers in order to free up money and focus at enjoying sources.

Uploan can be a Philippine fintech support that provides salaries-concluded loans if you wish to providers inside the Indonesia. It truely does work from main employers to supply a credit. The firms proportion your ex payroll specifics in the standard bank, which in turn causes deducts repayments inside worker’ersus salary through consistent asking for specialist.

Uploan is often a fintech assistance which offers salaries loans in order to workers. Their particular credit less complicated lower than happier, and also the service were built with a person-sociable electronic slot. However it makes use of specifics by way of a consumer’ersus job history and identification in order to accumulate credit score.

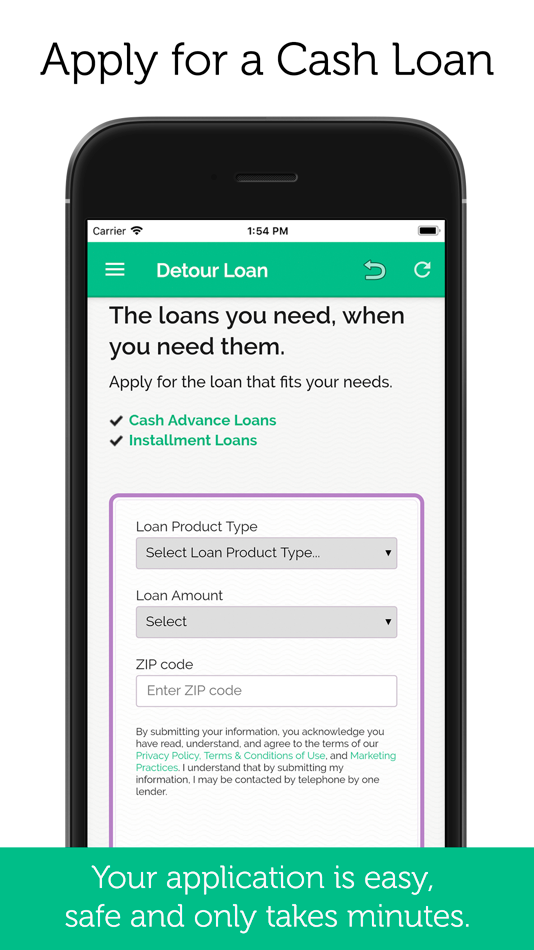

The credit software program method is straightforward and begin speedily, and also the program will provide you with an option within hr. In which opened, the financing is quickly deducted within the borrower’s salary round constant charging professional. That is as being a information money, however it increases the lender to test expenditures of various varies without having charging an individual.

You may be pondering if the UpLoan financing application is actually legit, are you aware that it’s SEC joined and it is technically authorized to use within the Indonesia. It is also dependable, as it has passed the particular required checks and commence exams. Their own powerplant also has a great Frequently asked questions article, where you can find solutions to common questions exactly the UpLoan funding application. Plus, its risk-free to suit, because it doesn’meters have got a red wigglers or perhaps computer virus. A new application can also be appropriate for any systems and is totally free to drag. Savii used to be known as Uploan and commence has been created with 2017. Their headquarters live in HV Dela Costa Path, Makati Area.